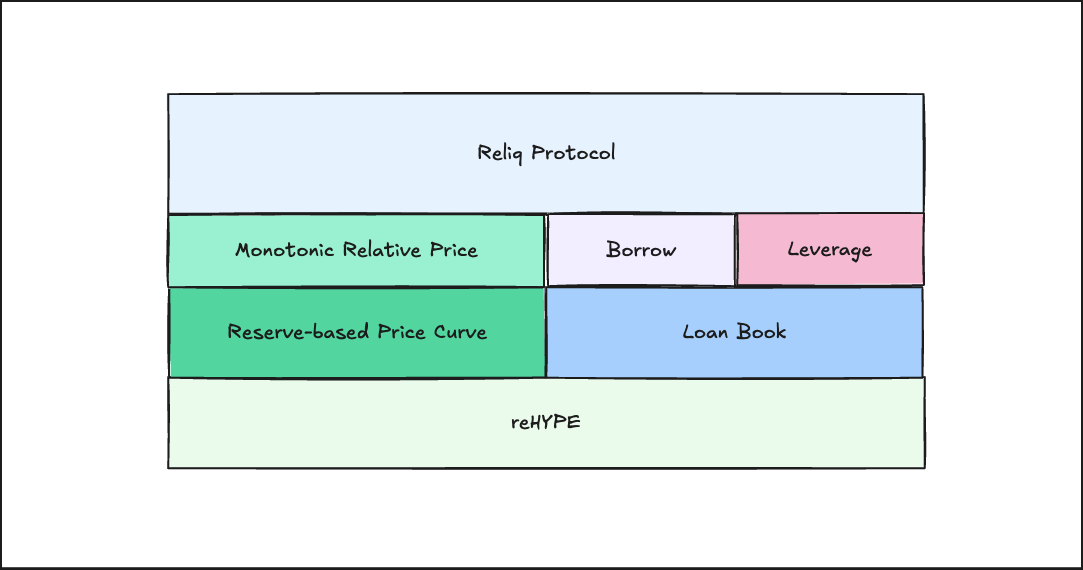

Welcome to Reliq

Reliq Finance is a DeFi Protocol on Hyperliquid. It's built as a monolith for HYPE-maxis, the place to bet on the collective belief in the apex-predator of assets, HYPE. Read on to learn about Reliq's key features and reHYPE, our HYPE-backed token.

$reHYPE

reHYPE is an asset-backed token issued by Reliq, collateralised by kHYPE (the premier HYPE LST from Kinetiq).

Participants can:

- Mint reHYPE by depositing kHYPE to earn yield

- Burn reHYPE to redeem underlying kHYPE at any time

- Enjoy full liquidity with no lock-ups

- Use reHYPE as collateral to borrow kHYPE at 99% LTV

The price can only go up

reHYPE is fully-backed by kHYPE and earns yield, which means the price of reHYPE increases over time relative to kHYPE. In fact, this is mathematically enforced inside the protocol: the price of reHYPE can only ever increase relative to kHYPE, never decrease.

Every time someone mints, burns, or borrows on Reliq, the fee is instantly routed to the kHYPE reserve, increasing the amount of kHYPE backing each reHYPE. This continuously raises the reHYPE/kHYPE exchange rate.

Loans

On Reliq, participants can borrow kHYPE against reHYPE collateral at 99% LTV.

The loans are:

- Fixed-term

- Fixed-fee

- No mid-term liquidations

The design allows for crafty, capital-efficient strategies. reHYPE holders can maintain exposure to growth and have access to liquidity too by borrowing kHYPE to deploy elsewhere.

The Temple of HYPE

Reliq has one single goal: maximise value for HYPE-maxis. Every facet is built and tweaked around the goal to drive maximum benefit to Reliq users. This is not your usual DeFi protocol, it's The Temple of HYPE.