Reliq: The Protocol

At its core, Reliq is an economic system that offers:

- Lucrative organic yield on HYPE

- Reliable, affordable, and capital-efficient kHYPE loans

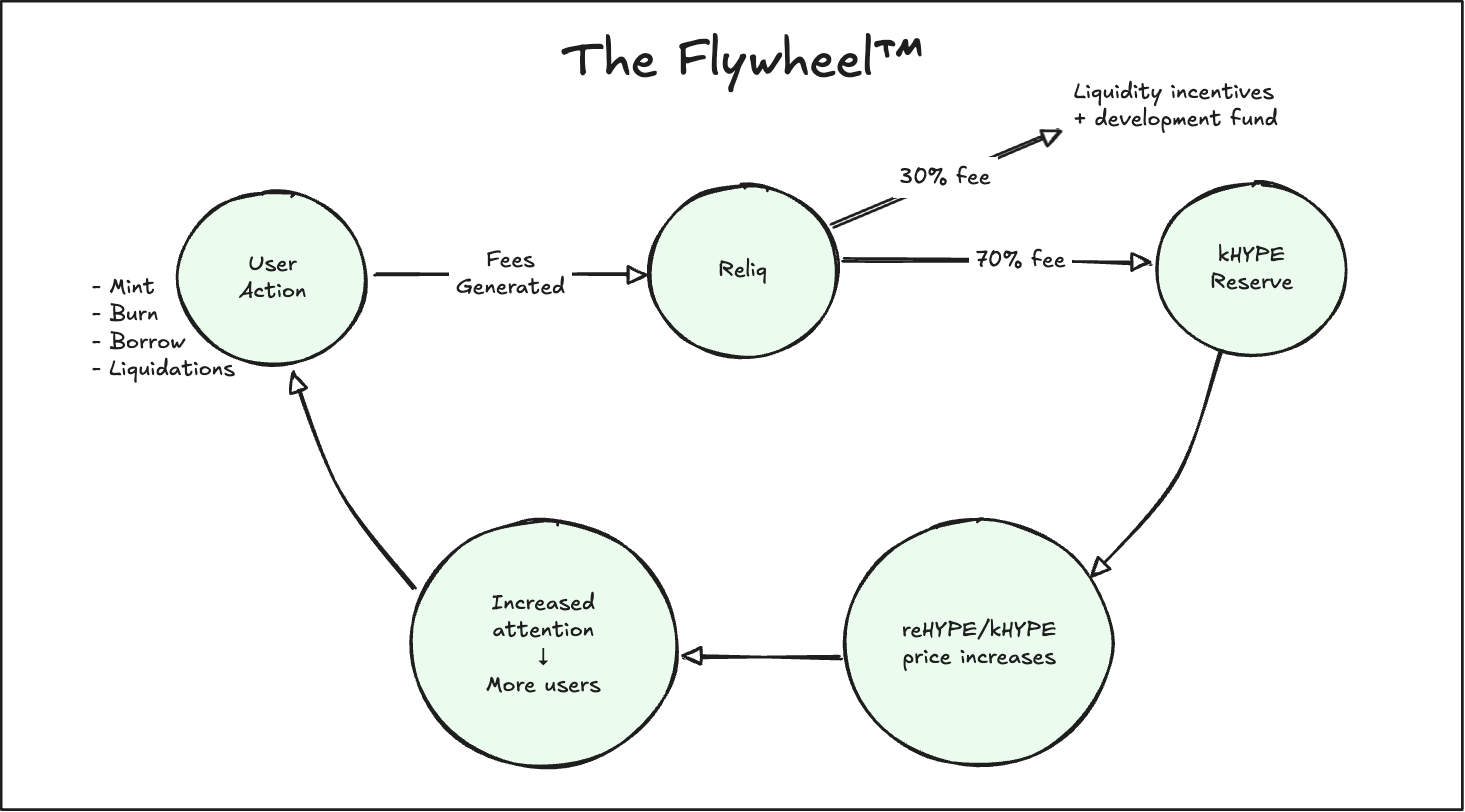

It's a closed financial loop, where every action enriches the kHYPE reserve, and drives more value to Reliq users. The more people participate, the higher the reHYPE price goes, attracts more participation, driving more value to Reliq users. A flywheel™ per se.

Maximal upside with minimal downside.

Core Components

reHYPE

- Fully backed by kHYPE in Reliq's reserve

- Liquid and tradable on secondary markets (UltraSolid-coded)

- Earns yield from both, HYPE's native staking yield through kHYPE, and Reliq's protocol revenue

- Accepted as collateral to borrow kHYPE at 99% LTV

The exchange rate between reHYPE and kHYPE is defined by reHYPE in circulation and the total kHYPE backing in the reserve:

reHYPE price = kHYPE backing / reHYPE supplyThe kHYPE backing includes:

- kHYPE held in Reliq's reserve

- kHYPE lent out through Reliq's loan book

Loaned kHYPE still backs reHYPE because loans require over-collateralization. Each loan locks up more reHYPE collateral than the kHYPE borrowed, preserving the backing ratio.

Minting & Burning

reHYPE can be natively minted & redeemed through Reliq.

Each mint or redeem:

- Routes majority of the fee into the kHYPE reserve.

- Increases the kHYPE backing per reHYPE.

- Pushes the reHYPE/kHYPE exchange rate upwards.

These operations are enforced by a contract-level invariant: any action that would reduce the reHYPE price simply reverts. Forming the foundation of the monotonically increasing curve.

Loans

Reliq offers fixed-term, fixed-interest loans at 99% LTV.

Borrowers can:

- Borrow kHYPE against reHYPE collateral

- Choose their loan term (1 to 365 days)

- Pay the computed interest upfront

- Enjoy stress-free debt capital, no liquidations before term end

Key Properties:

- 99% LTV: Put up $100 worth reHYPE, borrow $99 kHYPE

- Oracle-free: Debt is priced through Reliq's native exchange rate, no external price feeds

- Upfront, fixed-interest: Predictable cost of capital, no ongoing payments

- No mid-term liquidations: Plan strategies without fearing sudden liquidations. Liquidations only trigger if repayment fails at term end.

Leverage

HYPE believers can easily lever up on their conviction through Reliq's in-built leverage mechanism. Users can pay a fraction of the cost to get many multiples of exposure to Reliq's yield.

Users can also safely close their position at any time through flash close, allowing them to repay their debt by selling a portion of their reHYPE collateral in a single atomic transaction.

Pure, amplified, exposure to Reliq's yield.The Puzzle Fits

Every core component works in harmony to create a robust economic system that maximizes upside while minimizing downside.

- Native minting & burning enforce the core invariant: reHYPE price can only rise

- The loan book provides cheap, reliable kHYPE liquidity

- Leverage enables deep conviction and amplified exposure to Reliq's yield

- Arbitrage ensures the native price stays aligned with secondary markets

- Protocol fees continuously strengthen the kHYPE reserve

From arbitrageurs to whales seeking sustainable HYPE yield, Reliq offers a flexible, positive-sum system that rewards participation at every level.