Minting & Burning

reHYPE can be natively minted and burned through Reliq.

Minting reHYPE

Participants mint reHYPE by depositing kHYPE/HYPE into Reliq.

On every mint:

- If HYPE is deposited, it's first converted to kHYPE via Kinetiq

- kHYPE is added to the reserve

- reHYPE is issued to the participant

- A mint fee is collected

- Backing per reHYPE goes up

- The exchange rate increases

Minting strengthens the reserve and pushes the curve forward.

Burning reHYPE

Participants burn reHYPE to redeem their share of the underlying kHYPE.

When a user burns:

- reHYPE supply decreases

- kHYPE is returned to the participant

- A burn fee is collected

- Backing per reHYPE rises

- The exchange rate increases

Exits strengthen the system just like entries do. This is a unique design feature of Reliq.

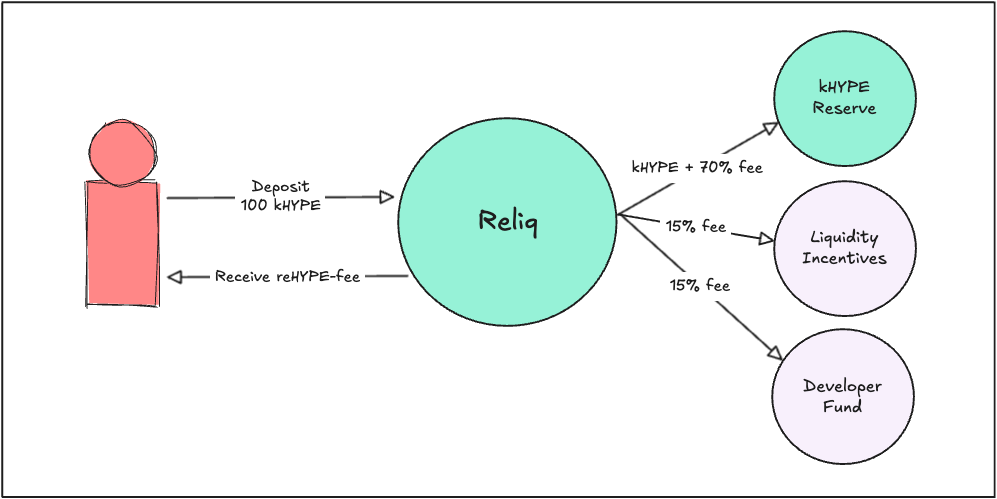

A majority share of every mint/burn fee flows directly into the kHYPE reserve. The remainder funds liquidity incentives and the development fund (exact splits are defined on the Fee Breakdown page).

Invariant

All mint, burn, and lending operations pass through a contract-level check. If an action would decrease the reHYPE price, the transaction simply reverts.